-1.png?width=108&height=50&name=Alta%20logo%20600x600%20(1)-1.png)

-1.png?width=108&height=50&name=Alta%20logo%20600x600%20(1)-1.png)

Accredited Investors only. See if you qualify.

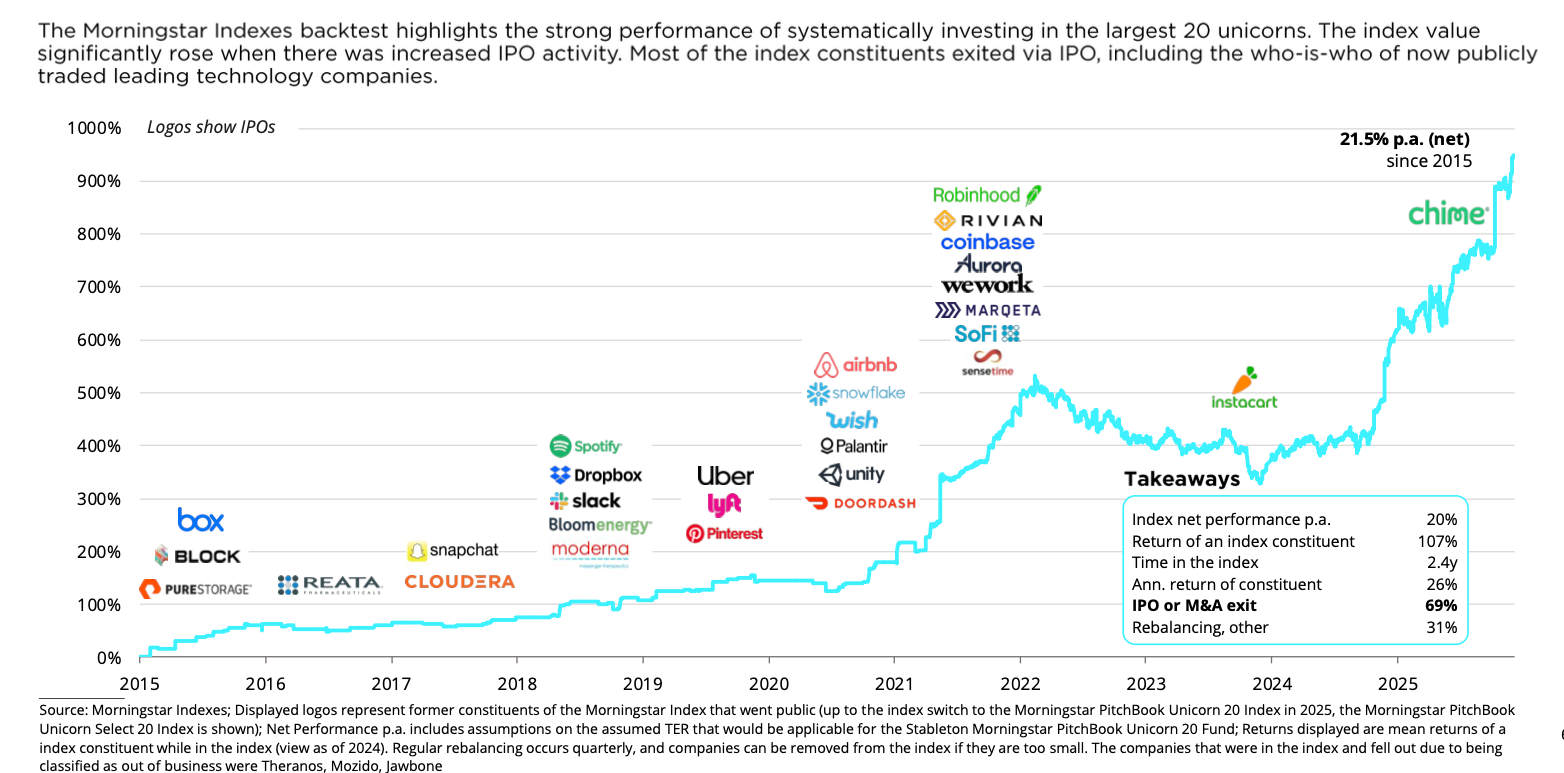

17.9% vs 43.9%

Performance in 2025

529.3%

Backtested Returns

US$625m+

100%+ CAGR since 12/2019

479.0%

VS Public Equities

“We are excited to see our new private market unicorn indexes being used by Stableton as a benchmark for its new investment offering. Investors now have the opportunity to gain exposure to the most promising growth opportunities in the market, which were previously difficult or even impossible to access.”

Sanjay Arya

Head of Innovation, Index Products at Morningstar“…we are proud to be the exclusive launch partner for the strategically important Stableton Unicorn investment offering, which offers our retail and institutional clients access to private market investments, a trend that is rapidly gaining momentum in the financial industry.”

Jan De Schepper

Chief Sales and Marketing Officer of Swissquote“Following Stableton closely, I can say, Stableton possesses a rare expertise and tech-enabled process edge to act on the most attractive late-stage venture direct secondaries.”

Michael Sidler

Co-Founding Partner at Redalpine"I am very impressed by the Stableton team and their ability to source top-tier investment opportunities continuously. I am looking forward to working with Stableton in the future.”

James Isilay

Founder and CEO of Cognism“It was a great experience working with Stableton during our last funding round and secondary transaction. We are happy to count Stableton among our shareholders and are looking forward to our journey together."

Renaud Laplanche

Co-Founder and CEO of Upgrade Inc.Why did the “Unicorn 20” fund significantly outperform the S&P500 in 2025?

S&P 500: +17.9%

Unicorn 20: +43.9%

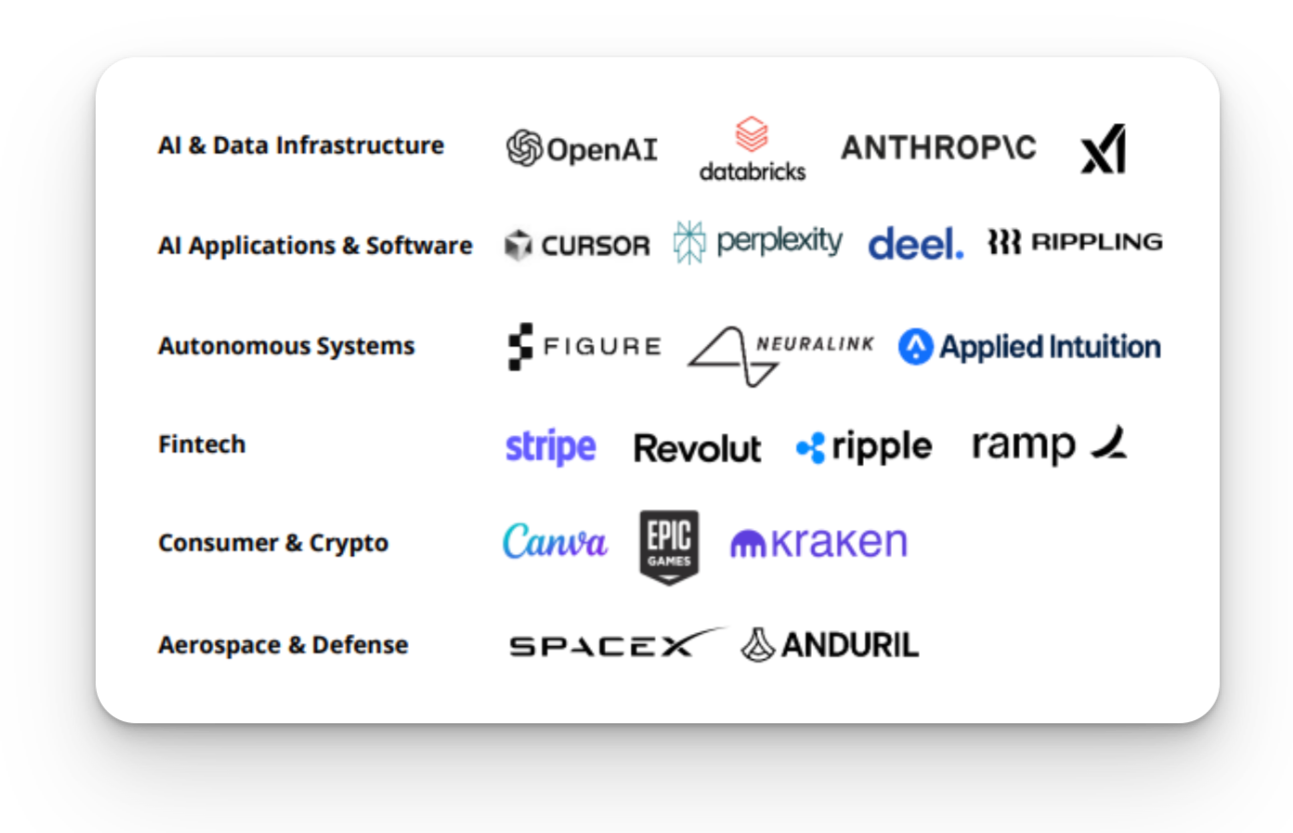

Backtested and indexed by Morningstar and Pitchbook, the “Unicorn 20” fund consists of:

Pre-IPO category leaders (20 most valuable unicorns) including SpaceX, OpenAI, and Databricks

That have consistently outperformed public markets and traditional VC strategies over the last 10 years.

Here are the 20 Unicorns you're getting access to in the Index.

Because the private market is notoriously challenging to access (and exit from).

For the first time ever, the "Unicorn 20" fund makes investing in Private Markets both accessible and seamless.

Gone are the usual challenges, such as:

Figuring out how to gain access to top-tier fund managers on the cap tables of Unicorns

Minimum ticket sizes of millions to invest in a single Unicorn

Hefty 20% performance fees

Funds locked up for 10+ years

Here what's broken in private markets, and how the Stableton Morningstar Pitchbook "Unicorn 20" Fund finally fixes things.

Complex Selection

Difficult to reliably value and pick private companies to invest in

Difficult Access

Top-tier VCs are difficult to find, access, and pick

High Min. Ticket Size

Often in the millions for 1 Unicorn alone.

High Fees

20% "Carry" or multi-Layer

Zero Liquidity

Funds locked for 10+ years

Difficult to Diversify

High barrier of access per company

Systematic Selection

Indexed and backtested by MorningStar. Mark-to-market Model with validated pricing data

Easy Access

Leading investor in private tech, on cap table of 25 Unicorns

Low Min. Ticket Size

A fraction of the ticket size for all 20 Unicorns

Lower Fees

Low cost, zero performance fees

Semi-Liquid

Quarterly redemptions

Built-in Diversification

Top 20 Unicorns in a 1 Index Fund

Accredited Investors only. See if you qualify.

.png?width=1080&height=300&name=LP%20image%20(6).png)

.png)

Here’s why:

SpaceX (now merged with xAI) is gearing up for a mega-IPO in 2026 with a valuation of $1.5 trillion, the biggest listing of all time

OpenAI is re-structuring for an IPO with a potential $1 trillion valuation

Anthropic is reportedly going public with a potential valuation above $300 billion

Kraken has filed for the IPO of its common stock

And we anticipate much more to come in 2026 (such as Databricks).

Best of all? All these names are in the "Unicorn 20" fund.

The anticipated combined valuations?

Over US$3.6 trillion.

In short, 2026 is positioned to be the largest single-year liquidity event in venture capital history.

Accredited Investors only. See if you qualify.

.png)

Click continue, and you're getting:

- The "Unicorn 20 Fact Sheet": All the facts and details at a glance

- The "Investment Memorandum": Detailed deck of Stableton's investment thesis, methodology, and track record

- Key Terms (min ticket size, fees) based on your investment amount (sent after "Accredited Investor" verification)

- Access to invest in the "Unicorn 20" fund (sent after "Accredited Investor" verification)

Get instantly verified as an Accredited Investor via SINGPASS after you click continue.

You qualify as an Accredited Investor if you meet at least one of the following criteria:

Net personal assets exceed SGD 2 million

Net financial assets exceed SGD 1 million

Income in preceding 12 months not less than SGD300,000

End Notes

[1] Stableton was awarded the “Growth Stage Start-up of the Year” in the Swiss Fintech Awards 2022

[2] Source: Stableton Unicorn Top 20 Fund, International Partner Presentation – June 2025

[3] Source: Stableton Unicorn Top 20 Fund, International Partner Presentation – June 2025

[4] Source: Stableton Unicorn Top 20 Fund, International Partner Presentation – June 2025

[5] Source: Stableton Unicorn Top 20 Fund, International Partner Presentation – June 2025

[6] Source: Stableton Unicorn Top 20 Fund, International Partner Presentation – June 2025

Additional Disclosures

Key Risks Associated with Tokenisation

Investors acquiring Tokens issued by the Custodian should carefully consider the following additional risks:

(a) No Market for the Tokens may Develop

The Tokens are a new issue of digital tokens, which are intended to be digital representations of the Shares. There will be no established trading market for the Tokens when issued, and one may never develop. There can be no assurance that a secondary market will develop or, if a secondary market does develop, that it will provide the holders with liquidity of investment or that it will continue for the life of the Tokens. The liquidity of any market for the Tokens will depend on a number of factors, including amongst others:

1. the number of Token Holders;

2. the performance of the Shares and overall financial markets and conditions;

3. the market for similar digital tokens;

4. the interest of traders in making a market in the Tokens;

5. regulatory developments in the digital token or cryptocurrency industries; and

6. legal restrictions on transfer.

The digital token market is a new and rapidly developing market, which may be subject to substantial and unpredictable disruption that cause significant volatility in the prices of the Tokens. As such, there is no assurance that the market, if any, for the Tokens will be free from such disruptions or that any such disruptions may not adversely affect the investors’ ability to sell their Tokens. Therefore, there is no assurance that the Token Holders will be able to:

1. sell their Tokens at any particular time;

2. receive a price upon sale that will be favourable;

3. realise any return on their Tokens; or

4. ensure that their entire investment in Tokens will not be partially or fully lost.

(b) The Potential Application of the Laws

The potential application of the laws of various jurisdictions to the Tokens is unclear and it is possible that certain jurisdictions will apply existing regulations on, or introduce new regulations addressing, blockchain technology, which may be contrary to the Tokens and which may, inter alia, result in substantial modifications of the sale of the Tokens, including termination and the loss of the Tokens.

The Tokens are novel and the application of securities laws of various jurisdictions to investors of security tokens is unclear in many respects. Due to the differences between the Tokens and traditional investment securities, there is a risk that issues that might easily be resolved by existing law if traditional securities were involved may not be easily resolved for the Tokens. In addition, because of the novel risks posed by the Tokens, it is possible that securities regulators may interpret laws in a manner that adversely affects the value of the Tokens. For example, if applicable securities laws restrict the ability for the Tokens to be transferred, this would have a material adverse effect on the value of the Tokens. In addition, regulators in various jurisdictions may promulgate new laws, regulations, guidance or compliance requirements that seek to regulate or otherwise impact security tokens.

The occurrence of any such legal or regulatory issues or disputes, changes in or uncertainty about the legal and regulatory framework applicable to the Tokens, could have a material adverse effect on the value of the Tokens.

(c) Custodian may be subject to Cyber Security and Data Loss Risks or Other Security Breaches

The Custodian may be subjected to a variety of cyber-attacks, which may continue to occur from time to time. While the Custodian will make every effort to implement appropriate security measures, there is no assurance that there will be no theft of the Tokens as a result of hacks, mining attacks (including, but not limited to, double-spend attacks, majority mining power attacks, "selfish-mining" attacks and race condition attacks), sophisticated cyber-attacks, as well as other new forms of attack that may be created, distributed denials of service or errors, vulnerabilities or defects on the Custodian, the relevant blockchain, or any other blockchain, or otherwise. Such events may include, for example, flaws in programming or source code leading to exploitation or abuse thereof. Mining attacks may also target other blockchain networks with which the Tokens interact (if any), which may consequently significantly impact the Tokens.

Smart contract technology is still in its early stage of development and there can be no assurance that such technology will function properly. Its application of experimental nature carries significant operation, technological, financial, regulatory, financial and reputational risks, there are inherent risks that such protocols, systems and/or smart contracts could contain weaknesses, vulnerabilities or bugs which could result in technological limitations on the purpose intended by Custodian and may contain flaws, vulnerabilities or other issues, which may cause technical problems or the complete loss of Tokens.

Token Holders should understand and accept that there are no warranties that the Tokens are fit for a particular purpose or do not contain any weaknesses, vulnerabilities or bugs which would cause loss in their worth or value.

(d) Any Technological Difficulties Experienced by the Custodian may Prevent Access or Use of the Tokens

The Custodian’s network or services could be disrupted by numerous events, including natural disasters, equipment breakdown, network connectivity downtime, power losses, or even intentional disruptions of its services, such as disruptions caused by software viruses or attacks by unauthorised users. These are beyond the control of the Custodian, and there can be no assurance that any of the Custodian's intended security measures will be effective. The Custodian may also be prone to attacks on its infrastructure intended to steal information about its technology, financial data or user information. Any significant breach of the Custodian's intended security measures or other disruptions resulting in a compromise of the usability, stability and security of the Custodian's network or services (including the private blockchain) may adversely affect the trading price of the Tokens.

The Custodian is subject to the risk of technological difficulties that may impact trading of the Tokens, which include, without limitation, failures of any blockchain on which the Tokens or the Custodian relies on or the failure of smart contracts to function properly. Trading in the Tokens will depend on the operation and functionality of the Custodian and if such system were to fail for any reason, trading in the Tokens could be impossible until such failure is corrected and full functionality is restored and tested. Any such technological difficulties may prevent the access or use of the Tokens. This could have a material impact on the Custodian's ability to execute or settle trades of the Tokens, to maintain accurate records of the ownership of the Tokens and to comply with the obligations relating to the records of the ownership of the Tokens and could have a material adverse effect on the Token Holders.

Disclaimer:

This material and its contents (“Information”) contained herein, including the statements, information and figures in relation to Stableton and the Top 20 Fund are provided by us and/or from public sources believed to be reliable. Alternative Investments Pte. Ltd., AltaX Pte. Ltd. and/or its affiliates (which in this Information are referenced as “Alta”, “we”, or ”us”) make no representation or warranty as to the adequacy, completeness, accuracy, reliability, forecasts, opinions or timelines of the Information for any particular purpose. The Information may be updated, revised, deleted, or modified without notice. Information should only be considered current as of the time of initial publication or as otherwise stated in the Information without regard to the actual date on which the Information may be accessed. We do not accept any responsibility or liability for any errors or omissions or for any loss resulting from the use of the Information.

This Information is intended for Accredited Investors or Institutional Investors (as defined under the Securities and Futures Act 2001 of Singapore) only. It is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed, and it is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. In particular, this Information may only be accessed by persons who are: a. not a U.S. person or within the United States. This Information is for the confidential use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute, or use the Information in any way. If you received it in error, please tell us immediately, delete it, any relevant emails and their attachments and return all copies of the Information to us.

This Information is intended for informational purposes only. The Information does not constitute an offer or invitation to purchase or subscribe for any securities in any jurisdiction by Alta. No part of this Information should form the basis of, or be relied upon in connection with, any investment decision or any contract or commitment to purchase or subscribe for any securities.

Where investment opportunities are mentioned, please note that the Information does not take into account the specific investment objectives, financial situation, or particular needs of any particular investor. Investment in any security entails significant risks, including illiquidity, lack of dividends, loss of investment, and dilution, and should be done only with an accurate understanding and complete acceptance of these risks. Investors should invest only if they have the financial ability and willingness to accept such risks. Advice should be sought from a financial adviser regarding the suitability of the investment opportunities presented, taking into account the specific investment objectives, financial situation or particular needs of any investor, before such investor makes a commitment to invest. Should the investor choose to do so, he should consider carefully whether the investment opportunities are suitable for him. In particular, all relevant documents pertaining to the investment opportunities should be read to make an independent assessment of the appropriateness of the transaction. Please click here to read the full Risk Warning.

Where third party sources have been cited, We have no duty to fact-check or verify the accuracy, truth, or completeness of information obtained from or provided to it by any third party, and disclaims to the fullest extent permitted by law all responsibility and liability for all loss, damage, or other adverse consequences arising out of or in relation to any reliance upon such information contained or referenced in this Information. Any past performance, projection, forecast or simulation of results is not indicative of the future or likely performance of any investment.

The provisions herein relating to Stableton and TOP 20 Fund are indicative only and to be used as the basis for the entering into of formal, binding agreements between the parties concerned. Nothing in this document should be taken as an advertisement making an offer or calling attention to an offer or intended offer of any investment, including but not limited to an investment in TOP 20 Fund.

This Information has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.

“Alta” and “Alta Exchange” are brand names and we reserve all rights to such names, and any references to, or derivatives of them. Alternative Investments Pte. Ltd. is a licensed fund management company regulated by the Monetary Authority of Singapore.

[PLEASE READ] IMPORTANT DISCLAIMER FROM STABLETON